Why this financial advisers' tool should be part of all our Financial Plans

You may already be familiar with the concept of cashflow planning or perhaps have seen a cashflow chart, which illustrates a person’s income and expenses over their lifetime. If you have ever engaged with a financial adviser, you have likely been shown a cashflow plan or had one created for you. Either way, you may well have questions about what cashflow planning is, why it's a useful tool, what benefits it can bring and whether you should adopt it when making your own financial plans.

Cashflow planning has become a crucial tool for financial advisers, enabling them to verify the viability of their plans while providing clients with clarity and reassurance. Advisers often describe the “aha” moment when clients first see their cashflow plan, as it brings their financial future to life and allows them to engage with it meaningfully.

Nowadays, consumer financial planning tools — such as the MyFinanceFuture Planner — make cashflow planning accessible to individuals, allowing you to try it yourself. But what exactly is cashflow planning? What essential features make it effective? Most importantly, how can you use it to improve your financial future?

Content

- The Questions You Are Trying to Answer in a Personal Financial Plan

- The Concept of Cashflow Planning and the "Single Cashflow Bucket"

- What Does a Cashflow Plan Look Like and What Can It Tell You?

- The Importance of Considering All Finances in Cashflow Planning

- Using a Cashflow Plan Once It’s Created

- The Long-Term Value of a Cashflow Plan

The Questions You Are Trying to Answer in a Personal Financial Plan

Many people start a financial plan with a significant life question, such as: “When can I retire?”, “Can I afford to fund my children’s education?”, or “What lifestyle can I maintain while saving enough for the future?”. The goal of a financial plan is to provide answers to these questions. However, these concerns rarely exist in isolation. Addressing one often raises others that require simultaneous consideration to avoid undesirable compromises.

For instance, a plan to fund a child’s education may lead to further questions: “Can I still retire by 60?”, “Will I be able to help my children with deposits for their first homes?”, and “Can I do this without downsizing until we are 75?” Financial planning must balance multiple objectives while ensuring sufficient funds for both present and future lifestyle needs.

Cashflow planning is an ideal tool for managing these complexities. However, to use it effectively, it is important to understand why it works and what key features are necessary.

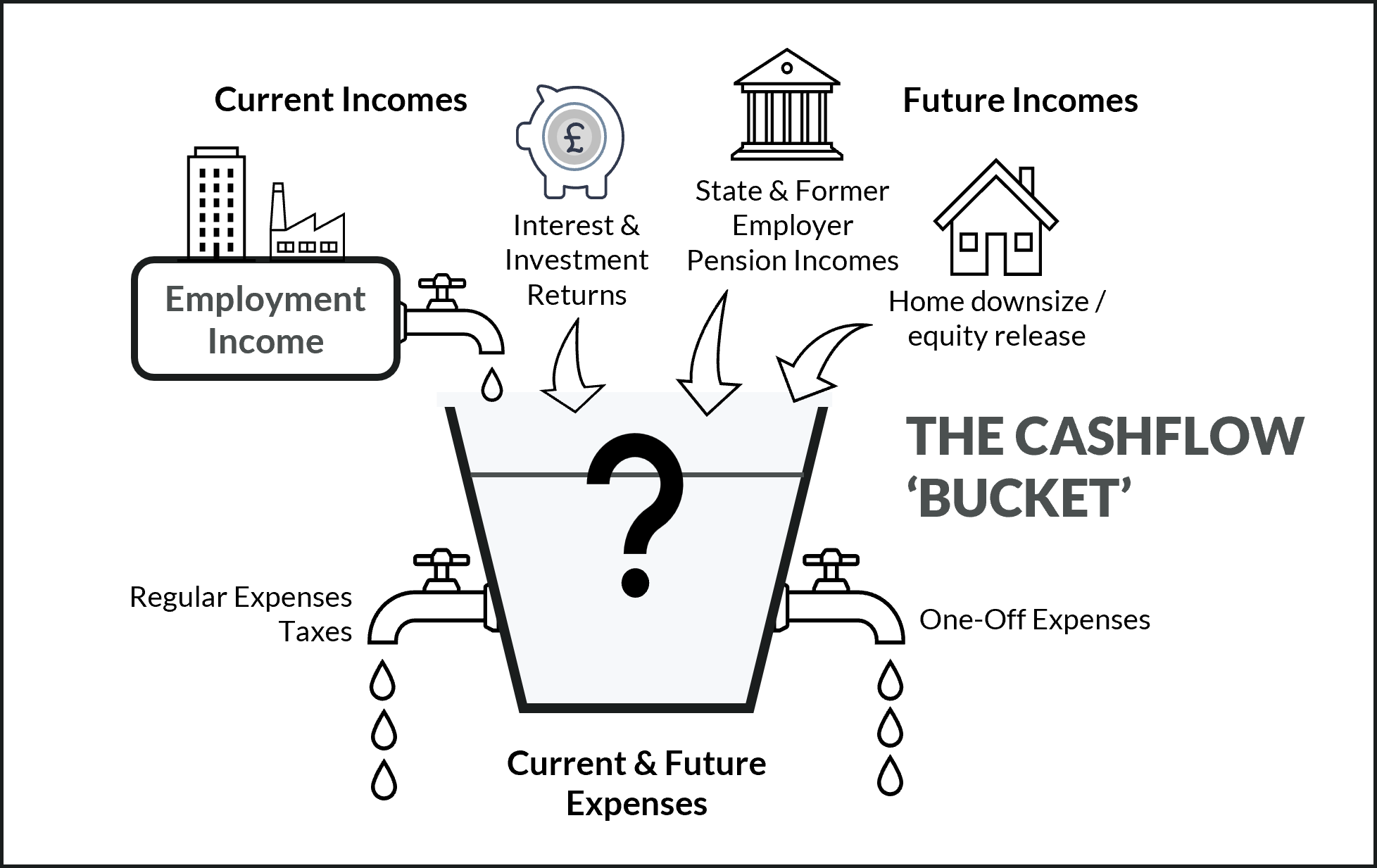

The Concept of Cashflow Planning and the "Single Cashflow Bucket"

Before exploring the specifics, let’s first understand the fundamental concept of cashflow planning.

A useful analogy is the "cashflow bucket". In this model, all income sources over a person’s lifetime are represented as liquid flowing into a bucket. Taps control the flow, turning on and off as income sources change, such as transitioning from employment earnings to pension income. At the same time, expenses act as drains, reflecting ongoing costs, one-time expenditures, and taxes.

The goal of cashflow planning is to ensure that income replenishes the bucket sufficiently so that it never runs dry. In financial terms, the bucket represents liquid assets—cash, accessible savings, and investment accounts. Effective cashflow planning ensures that these assets are sustained by income or fixed asset sales so that expenses can always be covered.

Cashflow planning tools project future cashflows and calculate the balance of liquid assets for each year. They do this by subtracting total expenses and taxes from total income annually, adding any surplus to assets and deducting any shortfall.

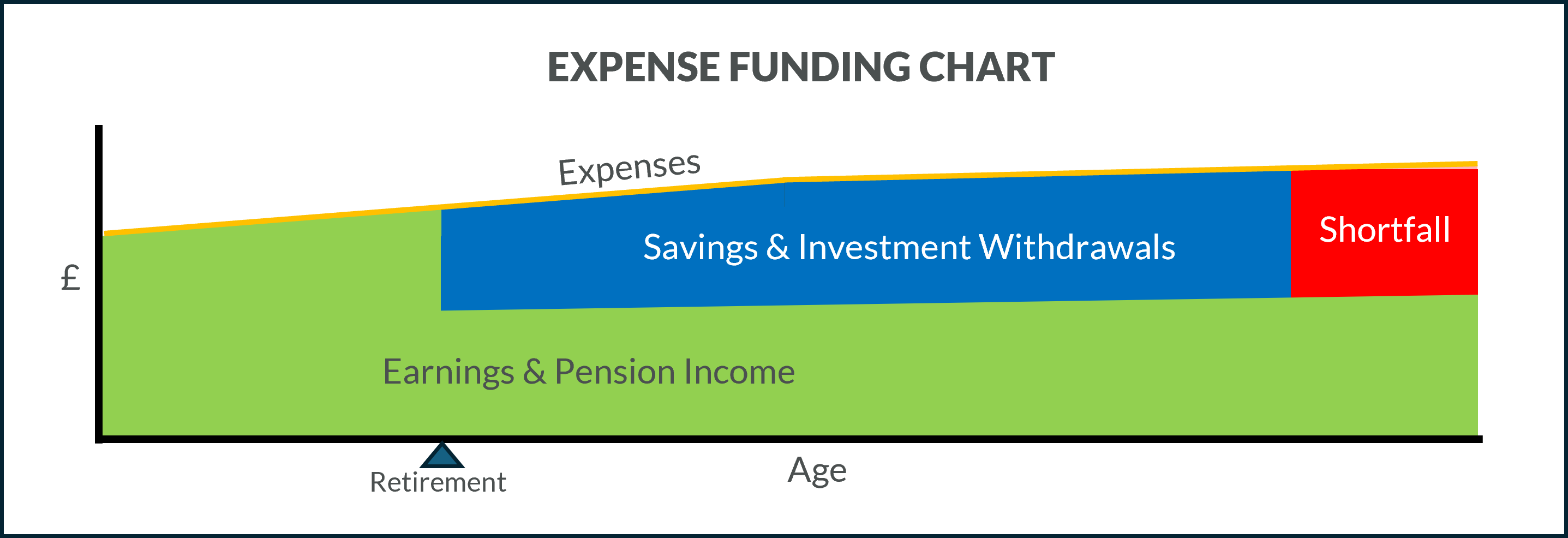

What Does a Cashflow Plan Look Like and What Can It Tell You?

A cashflow plan is typically represented as a chart showing how expenses are funded over time, accompanied by supporting visuals and data offering deeper financial insights.

The primary cashflow chart illustrates when expenses are covered by earnings and when they rely on savings or investment withdrawals. Before retirement, earnings usually cover expenses, whereas post-retirement, expenses are typically covered by a combination of pensions and savings withdrawals. The chart also identifies any overall shortfalls where income and savings are insufficient to cover expenses in certain years.

Additional charts and data often accompany the main cashflow projection, providing insights into net worth over time (i.e. assets minus liabilities), income and expense breakdowns, tax obligations, contributions to and withdrawals from savings and investments, the value of any legacy, and associated inheritance tax liabilities.

The Importance of Considering All Finances in Cashflow Planning

For a cashflow plan to be effective, it must encompass all aspects of your financial life. A comprehensive plan enables you to balance multiple objectives and make informed trade-offs, such as:

- Reducing spending now to save more for retirement or enable earlier retirement

- Choosing between saving into a pension or paying down a mortgage

- Deciding whether to work part-time in retirement

- Using property equity (via downsizing or a later-life mortgage) to fund retirement

- Structuring retirement income sources tax-efficiently

- Selecting tax-efficient savings and investment vehicles (e.g. pensions vs ISAs).

A complete financial picture is necessary for accurate tax calculations, which influence both present and future decisions. Incomes, savings, investments, and potential asset sales all contribute to tax planning. Expenses dictate how much can be saved and what needs to be funded later. Assets matter if they generate income or offer a source of funds through sale, downsizing, or security for borrowing. Debts must also be considered, as repaying them can be an alternative to saving.

For couples with shared financial responsibilities, both partners’ finances must be included in the plan. Joint decision-making often involves trade-offs, such as one partner working less to manage household responsibilities while still achieving mortgage repayment and retirement savings goals. Couples also have unique tax-efficiency strategies available, such as using one partner’s pension lump sum to contribute to the other’s pension for additional tax relief.

Using a Cashflow Plan Once It’s Created

Once you have created a cashflow plan, how can you use it to gain financial clarity?

Firstly, it helps you in working out how to address any shortfalls so that your plan is viable. This reduces uncertainty and ensures you are financially prepared for the future, reducing potential financial stress.

For example, a common shortfall occurs when money runs out late in life. A cashflow plan enables you to explore solutions such as:

- Reducing Current Expenses: lowering expenditures now allows more to be saved for retirement. While this can be challenging, it may be a viable solution for some.

- Downsizing or Releasing Home Equity: Switching to a less costly home or using home equity can help bridge financial gaps later in life.

- Lowering Retirement Expenses: Recognising that some costs decrease post-retirement (e.g. commuting and other work-related expenses) can help reduce retirement spending expectations and contribute to reducing a shortfall.

- Phased Retirement: Gradually reducing work hours can extend income streams and while also easing the transition into retirement.

- Tax-Efficient Retirement Income Planning: strategically managing retirement income can reduce overall tax liabilities, leaving more funds to cover expenses.

To evaluate these options, your planning tool should be able to model: different expense levels, both now and in retirement; current and future employments (both full- and part-time); property downsizes and later-life mortgages; and a range of investment contribution and withdrawal strategies for tax-efficient retirement income.

If your plan shows a surplus, you can explore opportunities such as early retirement, lifestyle enhancements, or legacy planning. Beyond that, scenario analysis helps you test how your plan responds to various personal (e.g. longevity, redundancy, ill health) and economic (e.g. market downturns, inflation) factors. For this your planning tool should provide scenario analysis features such as the ability to creating and compare multiple plans and adjust key assumptions.

The Long-Term Value of a Cashflow Plan

A carefully considered and tested cashflow plan provides peace of mind by ensuring that your financial future is well thought out and under control. Beyond immediate benefits, it serves as a valuable resource for responding to life changes, allowing for quick adjustments without starting from scratch.

Although creating a financial plan may initially seem daunting, embracing cashflow planning with the right tools ensures your plans are workable, comprehensive and resilient. It’s a one-off investment of time and effort that can pay off hugely in the future, in more ways than one: both financially, and in terms of overall well-being.

Happy Planning!

MyFinanceFuture Services Ltd does not offer regulated financial or professional advice.

If you have questions or feedback on the content of this post, please contact us here.

LOG IN

LOG IN

LAUNCH THE PLANNER

LAUNCH THE PLANNER