Build your own, personalised financial plan

To proceed, please choose the appropriate option below:

Premium Feature Highlights

- Set out your current financial situation in detail

- Include financial and life events planned for the future

- Choose how and when to take your pension

- Cashflow, assets & liabilities, income & expenses

- UK taxes (Income Tax, NICs, Capital Gains Tax, Inheritance Tax)

- Contributions to and withdrawals from savings & investments

- Detailed and summary views

- Explore different ways to take your pension and your pension income options

- Specify different investment types and asset classes

- Select contribution and withdrawal strategies

- Look at using home equity to fund retirement & later life

- See effects of higher inflation and/or lower investment returns

- Experiment with unexpected expenses or life events

- Create multiple scenarios

- Adjust your plan to respond better to adverse situations

- Review taxes projected for each year of your plan

- Identify unnecessary tax that could be reduced or avoided

- Try different approaches to reduce your lifetime tax bill

- Review your projected legacy and inheritance tax bill

- Try out strategies to reduce inheritance tax

- Find the right balance between gifting in your lifetime and gifting from your legacy

Detailed Premium Features List

| Premium | |

|---|---|

| Plan Management | |

| Create Plans | ✔ |

| Copy, Rename, Set Active & Delete Plans | ✔ |

| Multiple Plans | ✔ |

| Quick Plans (Mobile & Desktop) | |

| Inputs | |

| Family: Individual, Married / Civil Partner, Children | ✔ |

| Home: Main Home & Mortgage | ✔ |

| Other Property / Net Assets / Income: Total Value & Income | ✔ |

| Savings & Investments: Cash Savings, Taxable Investments, ISAs, DC Pensions | ✔ |

| Earnings: Current Employment & Retirement Date | ✔ |

| Spending: Current & Retirement | ✔ |

| DB Pensions: Future Income / Lump Sum & Pension Date | ✔ |

| Default Values | |

| Workplace DC Pension Contributions, Future Pension Options | ✔ |

| State Pension, Child Benefit (First Child), Retirement Spending | ✔ |

| Contribution & Withdrawal Strategies for Cash, Pensions & Investments | ✔ |

| Inflation, Returns & UK / English Tax Assumptions | ✔ |

| Switch to Full | |

| Populate Full Plan with Quick Plan Inputs & Default Values | ✔ |

| Review Process to Accept / Edit Default Values | ✔ |

| Full Plans (Desktop) | |

| Family | |

| Individual | ✔ |

| Married / Civil Partner | ✔ |

| Children | ✔ |

| Cohabiting partner | ✔ |

| Specify life expectancy (for self & partner) | ✔ |

| Assets & Debts | |

| Homes | |

| Current Main Home | ✔ |

| Current Mortgage on Main Home | ✔ |

| Current Second / Additional Homes | ✔ |

| Current Mortgage on Second / Additional Homes | ✔ |

| Specify Individual or Joint Ownership and Ownership % | ✔ |

| Home Disposal (Sale / Gift) | ✔ |

| Move Home (Downsize) | ✔ |

| Early Mortgage Repayment | ✔ |

| Retirement Interest-Only Mortgage | ✔ |

| Equity Release (Lifetime Mortgage) | ✔ |

| Rental Properties | |

| Current Residential/Commercial Rental Properties | ✔ |

| Current Rental Income & Maintenance Expenses | ✔ |

| Property Disposal (Sale/Gift) | ✔ |

| Current Buy-to-Let Mortgages | ✔ |

| Business Assets | |

| Current Business Assets, Dividend Income & Disposals | ✔ |

| Specify Owner/Manager Business Assets (Trading Business, Unlisted Trading Co Shares) | ✔ |

| Specify Tax-Advantaged Investment Assets (AIM IHT Shares, VCTs, EIS & SEIS) | ✔ |

| Other Assets & Debts | |

| Current Personal Valuables | ✔ |

| Current Household Assets | ✔ |

| Asset Disposal Options (Sale / Gift) | ✔ |

| Current Unsecured Debt Balance (Overdraft / Personal Loan / Credit Card) | ✔ |

| Early Debt Repayment | ✔ |

| Earnings & Pensions | |

| Employment | |

| Current Primary Employment / Self-Employment | ✔ |

| Multiple Employments / Self-Employments | ✔ |

| Future Changes in Employment (Promotions / Downshifts / Career Breaks) | ✔ |

| Workplace Defined Contribution (DC) Pensions | |

| DC Pension Contributions from Earnings | ✔ |

| Specify Net Pay / Relief-at-Source / Salary Sacrifice | ✔ |

| Specify Pensionable Earnings / Qualifying (Auto-Enrolment) Earnings | ✔ |

| Workplace Defined Benefit (DB) Pensions | |

| Active Workplace DB Pensions | ✔ |

| Deferred Workplace DB Pensions | ✔ |

| In-Payment Workplace DB Pensions | ✔ |

| DB Pension Contributions from Earnings | ✔ |

| Additional Voluntary Contribution (AVC) Schemes | ✔ |

| DB Pension Benefits | |

| Use Own Pension Quotation | ✔ |

| Automatic Benefit Projection for Active DB Pensions | ✔ |

| Specify Career Average Revalued Earnings (CARE) / Final Salary basis | ✔ |

| Options for Commuting Pension Income to Cash Lump Sum | ✔ |

| State Pension Deduction | ✔ |

| AVC Scheme Linked to DB Pension for Tax-Free Cash Rights | ✔ |

| State Pension | |

| Current/Future State Pension | ✔ |

| Savings & Investments | |

| Account Types | |

| Cash Savings | ✔ |

| Taxable Investments | ✔ |

| ISAs | ✔ |

| Personal Pensions/SIPPs | ✔ |

| Pension Flexible Income Drawdown | ✔ |

| Savings & Investment Returns | |

| Default Returns & Savings Rates | ✔ |

| Specify Investment Asset Allocations & Returns | ✔ |

| Specify Savings Rates | ✔ |

| Specify Investment Fees | ✔ |

| Contribution & Withdrawal Strategies | |

| Contribution & Withdrawal Approach for Cash, Pensions & Investments | ✔ |

| Specify Cash Emergency Fund & Withdrawal Buffer | ✔ |

| Set Contribution Limit to Show 'Spend vs Save' Behaviour | ✔ |

| Select Investment Contribution & Withdrawal Strategies | ✔ |

| Select 'Bed & ISA' Transfers from Taxable Investments to ISAs | ✔ |

| Prevent Discretionary Investment in Pensions Above the Lump Sum / Lifetime Allowance | ✔ |

| Use Available Personal Allowance to Reinvest DC Pension funds | ✔ |

| Pension Options & Allowances | |

| Early Pension Withdrawals (using UFPLS) | ✔ |

| Specify Pension Allocations (to Tax Free Cash, Flexible Income Drawdown, Guaranteed Income (Annuity) and Taxable Cash Lump Sum) | ✔ |

| Switch from Drawdown to Guaranteed Income (Annuity) in Later Life | ✔ |

| Specify Protected Lump Sum / Lifetime Allowance | ✔ |

| Specify Transitional Tax-Free Amount / Lifetime Allowance Previously Used Amount | ✔ |

| Specify MPAA Already Triggered | ✔ |

| Other Incomes | |

| Child Benefit | |

| Child Benefit | ✔ |

| Guaranteed Incomes (Annuities) | |

| Current/Future Lifetime Pension Annuities | ✔ |

| Current/Future Purchased Life Annuities (PLA) | ✔ |

| Specify Annuities (Single/Joint, Level/Escalating, Purchase Rate) | ✔ |

| Other Incomes | |

| Current Taxable Income | ✔ |

| Multiple Incomes | ✔ |

| Future Incomes | ✔ |

| Non-taxable Incomes | ✔ |

| One-off and Recurring Incomes | ✔ |

| Specify Income Durations | ✔ |

| Expenses | |

| Expenses | |

| Current Expenses | ✔ |

| Retirement Expenses | ✔ |

| Multiple Periods at Different Expense Levels Pre- and Post-Retirement | ✔ |

| One-off and Recurring Expenses Linked to Life Events | ✔ |

| Gifts | |

| One-off and Recurring Cash Gifts | ✔ |

| Economic & Tax Assumptions | |

| Default Inflation, Return and Tax Assumptions from Official Sources | ✔ |

| Override Default Inflation Rates | ✔ |

| Override Default Investment Returns & Savings Rates | ✔ |

| Override Indexation of Tax Allowances, Limits & Thresholds for Possible Future Policy Changes | ✔ |

| Apply Marriage Allowance | ✔ |

| Reinstate Lifetime Allowance & LTA Charge to Reflect Possible Future Policy Change | ✔ |

| Specify Brought-forward Annual Allowances for Pension Investment | ✔ |

| Default Tax Assumptions Based on UK / English Tax Rules (not Scottish income tax) | ✔ |

| Calculate Projection | |

| Calculate Deterministic Projection for Lifetime Income, Expenses, Assets & Debts | ✔ |

| Calculate Lifetime Investment Contributions & Withdrawals Based on Selected Strategy | ✔ |

| Calculate Lifetime Taxes (Individuals & Partners) | ✔ |

| Calculate Inheritance Between Partners | ✔ |

| Calculate Legacy | ✔ |

| Tax Calculations | |

| Income Tax | |

| Earnings & Property | ✔ |

| Savings & Dividends | ✔ |

| Pension Tax Relief, Allowances & Charges | ✔ |

| High Income Child Benefit Charge | ✔ |

| Residential Property Finance Costs Relief | ✔ |

| National Insurance | |

| Employment Class 1A | ✔ |

| Self-employment Classes 2, 4 | ✔ |

| Capital Gains Tax | |

| Investments | ✔ |

| Residential Property (with Private Residence Relief) | ✔ |

| Chattels | ✔ |

| Business Asset Disposal (BAD) Relief | ✔ |

| Stamp Duty (SDLT) | |

| English / N Irish SDLT on Downsized Home (not Scottish LBTT / Welsh LTT) | ✔ |

| Inheritance & Estate Tax | |

| Estate Value Calculation | ✔ |

| Spouse/Civil Partner Exemption (1st death) | ✔ |

| Agricultural/Business Property Relief (APR/BPR) (on death) | ✔ |

| Transferable NRB and Residence NRB (RNRB) (2nd death) | ✔ |

| RNRB Downsizing Addition (2nd death) | ✔ |

| Successive Charges Relief (2nd death) | ✔ |

| Annual Gift Exemption & Potentially Exempt Transfers (PETs) | ✔ |

| Estate Tax (Income & Capital Gains) | ✔ |

| Review & Analyse Results | |

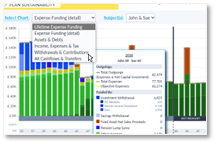

| Charts (Desktop) | |

| Summary Lifetime Expense Funding Projection | ✔ |

| Detailed Expense Funding Projection | ✔ |

| Assets & Debts (Lifetime view in Basic) | ✔ |

| Income, Expense & Taxes | ✔ |

| Contribution & Withdrawals | ✔ |

| All Cashflows | ✔ |

| Charts (Mobile) | |

| Summary Lifetime Expense Funding Projection | ✔ |

| Assets & Debts (Lifetime view) | ✔ |

| Metrics & Analysis (Desktop) | |

| Overall Plan Value including Shortfall & Legacy (Lifetime view in Basic) | ✔ |

| Overall Income & Expense Metrics | ✔ |

| Key Question Feedback | ✔ |

| Suggested Next Steps to Investigate Shortfalls | ✔ |

| Detailed Year-by-Year Chart Data Table | ✔ |

| Comparison of Charts and Metrics between Two Plans | ✔ |

| Summary of Plan Inputs | ✔ |

| Yearly Tax Return Summary | ✔ |

| Legacy & Inheritance Tax Summary | ✔ |

| Metrics & Analysis (Mobile) | |

| Lifetime Shortfall Feedback | ✔ |

| Support | |

| Help Centre | ✔ |

| Planning Guide | ✔ |

| Demo Plans | ✔ |

| Email Technical Support | ✔ |

| Security | |

| Two-Factor Authentication (2FA) | ✔ |

LOG IN

LOG IN Purchase Premium Access

Purchase Premium Access

LAUNCH THE PLANNER

LAUNCH THE PLANNER