Using Quick Plan: trying out changes to your plan (part 2)

So ask yourself the question: what if you had enough money in savings to consider retiring early? It may sound like an impossible dream to many, but those considering this option should ensure any decision is based on firm foundations.

This post is part of our series that uses MyFinanceFuture Planner’s ‘Quick Plan’ feature to illustrate the value of Financial Planning. The previous post, focused on changes to try if your plan has a shortfall, explored some of the options available to help fix an under-funded plan. This post looks the opposite scenario: changes to try if your plan has a surplus.

This post assumes you’ve already signed-up for the Planner’s free Basic service and used Quick Plan to create an initial financial projection. If you haven’t, you can try creating a Quick Plan now (you’ll be prompted to create an account first if you don’t already have one).

Now, consider your Quick Plan in more detail.

Before analysing the results, reflect on the assumptions

Before looking at the results of your Quick Plan, it’s important to reflect on the underlying assumptions and what these mean for the conclusions that can be drawn. As its name suggests, Quick Plan is designed to generate a projection quickly, based on a small amount of information about your financial situation and a lot of assumptions, so the time needed to create an initial plan is kept to a minimum.

The assumptions made by Quick Plan cover three main areas:

- your future (e.g. average life expectancies, no job changes before retirement, full state pension, keep property assets for life etc.)

- the economy (‘average’ investment returns, interest rates and inflation)

- details about you, your family and your current finances (e.g. number and ages of children, pension contributions, savings priorities, other pension details).

From this, it’s clear that Quick Plan’s results represent a simple, ‘average’ financial scenario, from which significant variations are possible in practice. Later in your Financial Planning journey, you’ll learn to ‘test’ your plan for a range of scenarios - such as longer-than-average life expectancy, lower-than-average investment returns and higher-than-average inflation – so you can plan how you would fund your retirement in these cases. We’ll get a taste of this later in this post. Nonetheless, despite Quick Plan’s simplicity, it can still be used to give an initial indication of what the future might hold, based on your current situation.

Now to consider the results.

What options should I try out with a surplus?

If your initial plan has a surplus rather than a shortfall, that’s clearly good news. It means that, with the assumptions made by Quick Plan, your projection does not run out of funds in the ‘average’ case described above. As a minimum, this means you have at least some surplus cash to help cover other situations requiring greater funding, such as longer-than-average life expectancy, lower-than-average investment returns or higher-than-average inflation. Bigger surpluses bring greater security, and even bigger ones might mean sufficient funds to consider changing the goals of your plan, for example to retire earlier, perhaps make a long-dreamed-of career change, improve your lifestyle, or provide extra support for your dependents.

You can use Quick Plan to try out a range of potential changes to the goals of your plan, to get a feel for the effect of different types and sizes of change. Perhaps try out an earlier retirement date or a higher level of spending in retirement. Try a range of inputs for each to see how much change is needed before introducing a shortfall (remembering that the resulting projections illustrate the ‘average’ case).

If one of your priorities is to leave a legacy – for example, to your dependants or to charity - then why not try different changes to see the effect on your plan’s End-of-Lifetime Value. It’s this value, which can be seen at the top of the Results screen, that - after deduction of inheritance tax (IHT) due – represents the basis for your legacy. Perhaps try (say) reducing retirement expenses or moving to a later retirement date to see by how much these changes could increase the legacy you leave behind.

Having tried out some changes to the goals of your plan, we can move on to look at the next stage in the Financial Planning journey – testing your plan.

Now test your plan

Once you have a plan for the ‘average’ case you’re broadly happy with, the next stage is to ‘test’ the plan to check it’s robust in case things turn out to be worse than average in real life. You can test the plan by seeing how it responds to a series of changes representing a range of adverse (i.e. non-'average') scenarios.

Which adverse scenarios should we consider when testing our plans? Good scenarios to consider include for example longer-than-average life expectancy (requiring additional funding), or adverse economic conditions such as lower-than-average investment returns or higher-than-average inflation. Also consider extreme economic events such as stock market crashes, house-price slumps and inflation spikes, and unexpected family events such as a severe illness or early death of a breadwinner. In many of these cases, your plan will require spare (i.e. surplus) funds or a shift in lifestyle to respond to the resulting negative effect on your finances. Many of these tests require the Full version of the Planner (of which more below), but there are some tests that can be done using Quick Plan to give you a sense of what’s involved.

Two examples of tests that can be tried using Quick Plan are as follows, each requiring the Quick Plan inputs to be adjusted to model the associated impact on your finances:

- a spike in inflation at the start of the plan, which can be modelled by increasing spending - including retirement spending, if entered - to represent the effect of the inflation spike (the increase could be - say - 5-10%, depending on how severe you want to make the test)

- a stock market crash at the start of the plan, which can be modelled by reducing the value of investments to represent the net effect of the crash on longer-term valuations (say 10-30%).

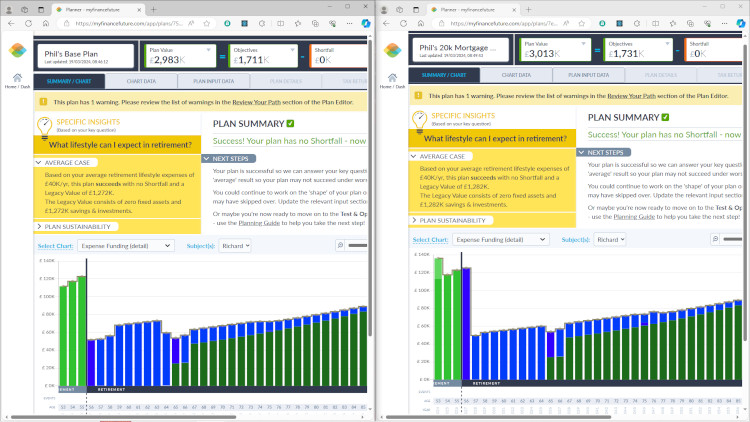

These tests can be run without having to re-enter all your plan information. You can instead re-use your existing plan by creating a copy using the Copy Plan feature (available from the Dashboard via the menu icon that appears on each Plan tile, and from the Copy icon in the right-hand bar in the Results screen). Give the copy a meaningful name describing the scenario, then edit the copy to update the relevant input values to create the test scenario. Finally, view the results and compare them to the results of the original plan to see the effect of the changes. (Plans can be compared by opening the Planner in two browser windows and opening both plans at the same time, one in each window as shown below.)

If the test scenario shows a shortfall, you can experiment to see how much more you would have to save for retirement to cover the shortfall, perhaps by spending less before retirement or by retiring later. Or you could try reducing your retirement expenses to see how much your retirement lifestyle would have to change to avoid a shortfall.

This should give you some idea of the process for testing your plan, within the capabilities of Quick Plan. The Full version of the Planner also allows a range of other tests to be made by varying key assumptions such as inflation rates, interest rates, investment returns and life expectancy. It also helps you optimise your plan by giving access to a breakdown of the taxes you’re projected to owe each year, which can be used to work out how to reduce your tax liability. Taxes covered in the Full version include inheritance tax (IHT), so it can also help you work out how to increase the after-tax value of your legacy.

We’ll cover how to use the Full version of the Planner in more detail in future posts. For now, it’s time to reflect on what you’ve learned so far.

Take time to reflect before considering your next steps

If your experience is anything like mine, you'll know that Financial Planning isn't just about understanding how to make big financial decisions, except occasionally when there’s a big decision to be made. More often, its main value is to help you learn where you stand financially and how the future is likely to play out, so you can be clearer on your general direction of travel and make smaller decisions with more confidence and an understanding of the broader picture. When the time comes for a big decision, you usually have your broader life goals and lifestyle to consider as well as your finances, so it becomes a more emotional decision than a purely rational one. The more ‘rational’ role played by Financial Planning becomes an input into the broader decision, which can take time to make well so you’re comfortable with the outcome.

If this is your first exposure to Financial Planning, take time to reflect on what you’ve learned. For example, if you were trying out changes to a plan with a surplus, you may have noted the trade-off between changing your goals to make the most of the projected surplus and keeping funds in reserve as a buffer in case of worse-than-expected economic conditions. Ask yourself, what insights came from trying out changes to your initial plan or from testing it for different scenarios, and what might these mean for you in practice? Have they raised or clarified any unresolved questions about the future ? Or highlighted the options you have available or may need to choose between later ? If so, would a more thorough planning exercise be a good next step to help advance your thinking?

Also, consider what you’ve learned about Financial Planning and what it can offer. Does it feel like a useful thing to do? Does it feel like something better left to the experts, or something where you have the confidence – or might be able to develop the confidence - to do it yourself?

Either way, watch out for future posts helping you explore the next stages in your Financial Planning journey.

In the meantime, Happy Planning!

MyFinanceFuture Services Ltd does not offer regulated financial or professional advice.

If you have questions or feedback on the content of this post, please contact us here.

LOG IN

LOG IN

LAUNCH THE PLANNER

LAUNCH THE PLANNER