Content

- What are the budget pension changes?

- What opportunities are they creating?

- Why are they creating uncertainty?

- How can I use the MyFinanceFuture Planner to help me consider my options?

What are the budget pension changes?

Chancellor Jeremy Hunt took almost everyone by surprise with his pension changes in the 2023 Spring Budget. The biggest change (and surprise)? Rather than increase the Lifetime Allowance (LTA) threshold as widely trailed, Hunt left the threshold unchanged (at £1,073,000) and instead reduced much of its effect by removing the LTA Charge on benefits taken (termed “crystallised”) above the LTA.

In a bit more detail, removing the LTA Charge means that:

- For income benefits - including pension incomes, annuities and flexible income drawdown funds – the LTA Charge (previously 25%) has been removed entirely, though income tax will continue to apply as before when the income is received

- For lump sum benefits, the previous flat-rate LTA Charge of 55% has been replaced by instead including the lump sum as part of income for tax purposes, incurring tax at the beneficiary’s marginal rate (of 0% - 45%).

As well as removing the LTA Charge, the Chancellor made several other significant changes, including:

- increasing the Annual Allowance for pension saving to £60,000 (from £40,000)

- reducing the impact of the Annual Allowance “taper”, which applies to higher earners, by both increasing the income threshold at which the taper starts to £260,000 (from £240,000) and increasing the minimum tapered Annual Allowance to £10,000 (from £4,000)

- increasing the MPAA - or Money Purchase Annual Allowance, the amount that can be saved into a pension pot after flexible pension withdrawals have started - to £10,000 (from £4,000).

What opportunities are they creating?

The changes bring with them a wide range of opportunities for pension savers, several of a scale prompting those affected to consider changes to pension savings and withdrawal plans. Whilst the headlines have focused on the potential benefits for higher earners, there are some potential benefits for middle and lower earners too.

Perhaps the most obvious opportunity is for those who already have accrued pension benefits above the LTA and are reaching the age at which they can take their pensions. In this case, the removal of the LTA Charge gives an immediate uplift in after-tax pension benefits on crystallisation, compared to those that would have been received before 6 April.

For those who haven’t saved much into pensions previously and are now on a higher salary, so can afford to save more and want to make up for lost time, the higher Annual Allowance means a pension pot can be built more quickly than before through higher pension contributions.

For those who retired taking their pensions in the last few years and considering returning to work to supplement their income in response to the cost-of-living crisis, the increase in the MPAA offers some help, with potentially benefit for middle and lower earners. The increase allows more of the income from a return to employment to be saved into a pension, benefitting from the associated tax relief in the short term and tax-free cash on subsequent withdrawal.

There are other opportunities relevant to specific cases, depending on earnings, pension savings, age, time to retirement and other factors. Everyone’s circumstances are different, so we each have to see which of the many ideas and suggestions are relevant and work out which of these are most suited to and benefit our own situations. At the same time, we should consider how to handle the uncertainty created following the budget changes.

Why are they creating uncertainty?

Whilst creating some short-term opportunities, the Chancellor's removal of the LTA Charge has resulted in increased uncertainty in the longer term. The changes prompted the Labour Party to counter with a pledge to reinstate the LTA Charge if it wins the next election (due by early 2025), replacing the general removal with a targeted scheme for doctors though with limited detail on how this would be done. Since pensions are generally long-term investments rather than savings for the next 18 months, for many the best strategy now appears unclear. The degree of uncertainty and potential impact depends - again - on individual circumstances.

There is a particular dilemma for those with a pension fund approaching the LTA threshold, who are nearing retirement age but can’t crystallise their pensions before the next election. A question in this case is whether to take the opportunity created by the higher Annual Allowance and removal of the LTA Charge to save more into pensions over the next two years and so exceeding the LTA, in the hope that even if the next government does reinstate the LTA Charge it would also provide protections for those over the LTA at that point (i.e. similar to the protections provided by HMRC on previous occasions when the LTA itself has been reduced). It’s a tricky decision and one where most would want to understand the impact of the potential downside before deciding whether to proceed.

Even those in a position to take their pensions this year to benefit immediately from the removal of the LTA Charge face some level of uncertainty. In this case, if the LTA Charge were not to be reinstated after the next election (or reinstated with protections), it may seem more attractive to some to continue working and saving into a pension in the hope of taking a larger pension with no LTA Charge in a few years’ time. Again, it’s a decision where understanding the impact of the potential downside is an important consideration.

The questions raised may appear difficult to answer, since analysis to understand the financial and tax implications on individual situations of decisions that might be taken by the next government is not straightforward, certainly without appropriate tools.

How can I use the MyFinanceFuture Planner to consider my options?

The good news is that the Planner now has a feature to help navigate the uncertainty following the budget. A new option allows assessment of the impact on your plan of the LTA Charge being reintroduced in the future - without protections - so the impact of this scenario can be assessed and a more informed decision made on pension savings and withdrawal strategy.

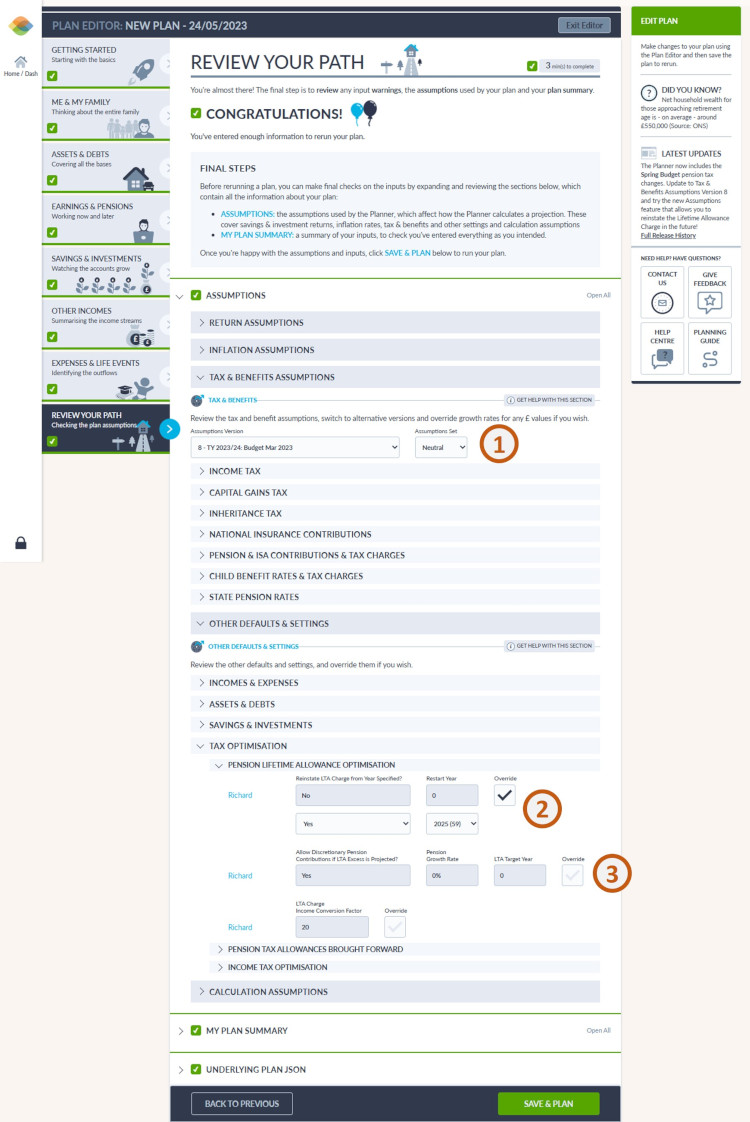

The new feature can be accessed by:- Updating your plan to adopt the latest tax rules following the Spring Budget (if not already done). This can be done in one click from the button in the banner on the Results screen, or by moving the Tax & Benefits Assumptions on to Version 8 under Review Your Path > Assumptions > Tax & Benefits Assumptions (marked (1) in the screen print below)

- Opening the Pension Lifetime Allowance Optimisation Assumptions to access and override (as desired) the assumptions on reinstatement of the LTA Charge under Review Your Path > Assumptions > Other Defaults & Settings > Tax Optimisation > Pension Lifetime Allowance Optimisation (marked (2) in the screen print below)

Screen print of the Review Your Path screen showing assumptions used to set up LTA Charge scenarios

Updating the assumptions is one step in the process of assessing the impact of LTA Charge reinstatement on your plan. Here’s an example outline of one process that might be followed to assess the potential impact of reinstatement of the LTA Charge:

- Review your Plan Results before reinstating the LTA Charge

- Create a duplicate copy of your plan as a basis for comparison (from the Dashboard)

- Update the assumptions to reintroduce the LTA Charge from a future date (as described above)

-

Compare the revised Plan Results to the previous results

- use the Plan Value KPI to give an initial, overall view

- Use the Income, Expenses & Tax Chart and Chart Data tab to see the different annual tax impacts

-

Consider alternative contribution and withdrawal strategies, using further duplicate plans and comparing results with your initial plan, for example:

- bringing forward crystallisation of a pension over the LTA so it happens before the LTA Charge is potentially reinstated. This could be done for Defined Benefits (DB) Pensions in Earnings & Pensions > Pension Rights, or for Defined Contributions (DC) Pensions in Savings & Investments > Pension Options & Allowances

- avoiding additional pension savings taking the pension fund over (or further over) the LTA, if the crystallisation can't be brought forward to before the LTA Charge is potentially reinstated. This could be done for example by changing workplace pension contributions (in Earnings & Pensions > Employment), by changing contribution priorities (in Savings & Investments > Contributions & Withdrawals), or by suppressing discretionary pension contributions over the LTA (in Review Your Path > Assumptions > Other Defaults & Settings > Tax Optimisation > Pension Lifetime Allowance Optimisation, marked (3) in the screen print above)

- Use the result of the comparisons to help you work out your preferred strategy

- Consider taking regulated financial advice before acting on decisions on pensions, since in many cases – such as the decision to crystallise a pension – actions cannot be reversed once taken.

Why not use the Planner to help you work out your strategy?

MyFinanceFuture Services Ltd does not offer regulated financial or professional advice.

If you have questions or feedback on the content of this post, please contact us here.

LOG IN

LOG IN

LAUNCH THE PLANNER

LAUNCH THE PLANNER