Build your own financial plan

no retirement plan[1]

‘comfortable’ retirement[2]

[1] UK Adult Financial Wellbeing Survey 2021 Future Focus Report (Money & Pensions Service, October 2022)

[2] The PLSA/Loughborough University Retirement Living Standards 2025 (Pension & Lifetime Savings Association, June 2025)

[3] The UK Advice Gap 2021 (OpenMoney, 2021)

Answer your most important financial questions

Big questions about the future become important at key decision points in our lives. Which are yours?

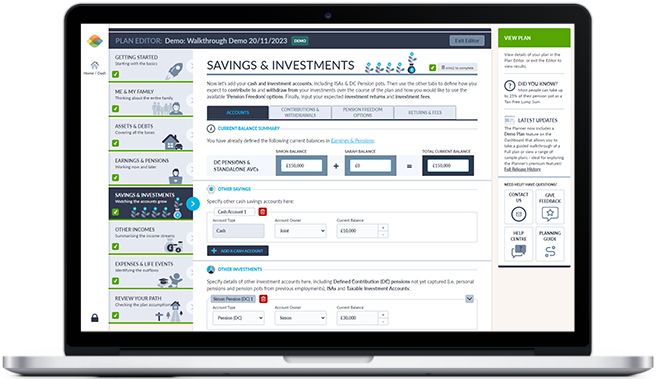

Take everything into account

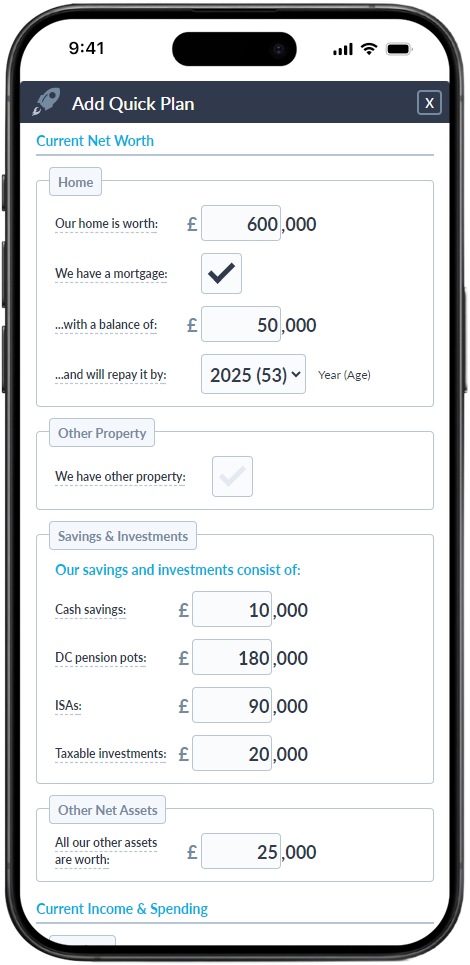

The MyFinanceFuture Planner provides a straightforward, step-by-step way to create a plan covering all your finances.

Easy to get started

Ask our users what they think

Some of the feedback we’ve received from customers of the Planner

Feedback received from customers since launch and from our preceding free pilot

... or ask a professional Financial Planner

“The Retirement Café” YouTube

Channel & Podcast

Find out more

Take a more in-depth look at the Planner’s Features, or see our Resources section for more thoughts, views and tips on financial planning

LOG IN

LOG IN

LAUNCH THE PLANNER

LAUNCH THE PLANNER